Table Of Content

- Compare the best home insurance companies in Florida for 2024

- Is mold covered by Florida home insurance?

- Insurance costs a concern going into hurricane season

- Will my Florida home insurance policy get canceled?

- Average Homeowners Insurance Cost by Company

- Cheap Florida Homeowners Insurance Cost Comparison

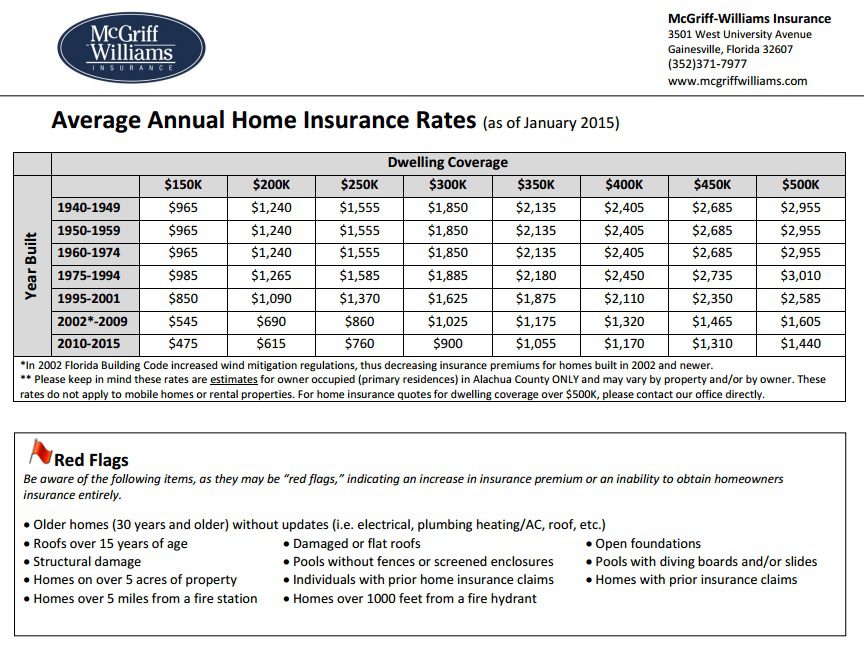

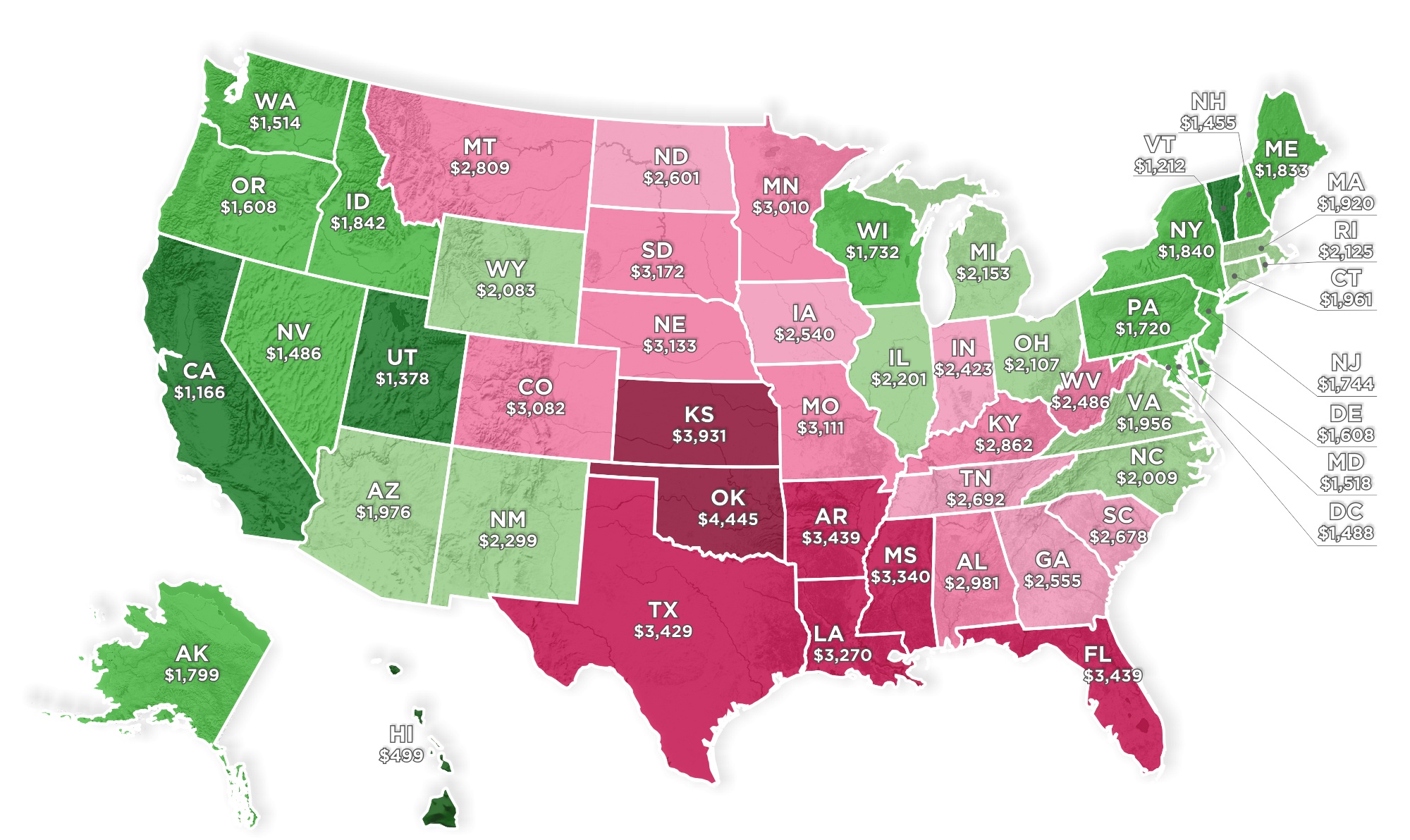

The National Flood Insurance Program (NFIP) paid out $913 million to U.S. homeowners last year, and $629 million of that went to residents in Florida. Major flooding from hurricanes and storm surges caused most of the payouts. State Farm, Stillwater, American Family, Farmers, and Nationwide offer top-notch insurance. Whether you live in a hurricane-prone part of South Florida or own a rental property in a less populated area, like Chipley, you should always try to get the lowest rate possible for the coverage you need. Along with the amount of coverage level, your dwelling’s age, location, material construction, and fire protection class may also affect rates.

Compare the best home insurance companies in Florida for 2024

Your policy number and claim number are required to access your information. FIGA covers all outstanding claims filed before the company was ordered into liquidation. Policyholders must resolve claims with FIGA within one year after the claim filing deadline. If you are not satisfied with the result of your claim, you can file suit against FIGA before the deadline. Citizens has a $700,000 dwelling limit in most counties except Miami-Dade and Monroe, where the dwelling limit is $1 million.

Progressive customers in Florida should 'keep an eye' on mailbox as company drops home insurance policies, expert ... - WJXT News4JAX

Progressive customers in Florida should 'keep an eye' on mailbox as company drops home insurance policies, expert ....

Posted: Thu, 25 Apr 2024 19:55:10 GMT [source]

Is mold covered by Florida home insurance?

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Insurance costs a concern going into hurricane season

Your mortgage company may require hazard insurance in Florida, but every responsible homeowner knows that they need coverage no matter what. And, at Kin, we’re committed to making it quick and easy to get Florida homeowners insurance quotes. So if you have $300,000 in dwelling coverage and a 2% hurricane deductible, you’d be responsible for $6,000 toward a hurricane-wind loss. Unfortunately, Flroida is one of the states with increasingly frequent and increasingly powerful natural disasters, including hurricanes and tropical storms. Having a comprehensive homeowners insurance policy gives you peace of mind, knowing that if the worst should happen, you can get back on your feet as soon as possible. A deductible is the amount of money you must pay before your insurance company starts paying for the losses covered under the policy.

Mold that results from a covered peril -- such as a burst pipe -- is covered under a Florida home insurance policy. It might be possible to increase such limits by paying an additional premium amount. It's important to note that some policies do not cover mold damage at all, depending on the insurer. “Conduct an insurance review with your insurance agent to identify any gaps in coverage.

The insurer may consider the age of the home, roof, plumbing, electrical wiring and the heating and air conditioning systems. They consider the condition and location of the home and who occupies it. Most insurers believe the presence of certain animals on the premises increases liability risk. Policies must include at least $2,000 of loss assessment coverage with a deductible no greater than $250. This coverage pays for your share of expenses for a covered loss to common property shared by all unit owners, up to the coverage limit.

The program offers inspections and grants up to $10,000 to help residents upgrade homes and qualify for property-insurance discounts for residences valued up to $700,000. Insurance has been a concern for many in the Sunshine State going into the hurricane season this year. With the amount of risk posed by strong storms and hurricanes, insurance rates are expected to continue rising. The cheapest home insurance cost estimate is $746 a year from Progressive, based on Forbes Advisor’s analysis of nationwide costs among large insurers. Personal property coverage pays to repair or replace your belongings, such as furniture, appliances, clothing and other household items, if they’re damaged or destroyed by a problem covered by your policy, such as a fire.

The insurance market instability has forced many Floridians to search for other home insurance companies. It’s also led the state’s insurer of last resort, Citizens Property Insurance, to jump to 1.3 million policyholders. State Farm is the best home insurance company in Florida, based on our analysis of rates, customer service ratings, and financial stability.

Even Florida homeowners who currently have insurance in place are still at risk of losing coverage. If they deem your home too risky to insure, they can cancel or not renew your policy. Even if your home is insurable and you don’t have a claim history, insurance companies could choose not to sell policies in a specific county due to the risk of litigation, says Friedlander. Even if you have never submitted an insurance claim, you could be penalized due to the past claims of the previous owner.

8 new home insurance companies approved to enter Florida market - WESH 2 Orlando

8 new home insurance companies approved to enter Florida market.

Posted: Fri, 05 Apr 2024 07:00:00 GMT [source]

When buying homeowners insurance in Florida, there are two additional insurance options you may need to consider to protect against the state’s frequent hurricanes and flooding. With the news that Florida Peninsula Insurance and Heritage Property Insurance were slashing claim payouts to homeowners after Hurricane Ian, now it’s more important than ever to find a company with high claims satisfaction. Power’s 2023 Claims Satisfaction Study or the National Association of Insurance Commissioners Complaint Index for a look at what companies fare well when it comes to claims and customer service. How much dwelling coverage you purchase should be based on the replacement cost of your home — not its market value. That means even if you paid $600,000 for a home that would really only cost $400,000 to rebuild — you’d only need $400,000 in dwelling coverage.

When you have a loss, it is your responsibility to know what property you have, when it was purchased, how much you paid for it, and how much it will cost to replace it. You should also keep receipts for large purchases or keep your credit card statements. It is always a good idea to take pictures or videos of your property as well.

Florida homeowners who have lost coverage because their insurers have gone out of business or stopped renewing policies often struggle to find coverage in the private market. Many homeowners are turning to the “last resort” option, Citizens Property Insurance Corp.. Thousands of Floridians have had to scramble to find new homeowners insurance after their insurers were liquidated, went out of business or simply stopped selling policies in the state. The rate increases are connected to a new FEMA program called Risk Rating 2.0, which bases rates on an individual property’s risks, not flood maps.

A standard home insurance policy (designated as HO-3) covers your house for any mishap that’s not excluded in the policy. Common exclusions include sinkholes, power failure, neglect or wear and tear, nuclear hazard, vermin and insect infestations and intentional damage. Fortunately, Florida insurance companies are legally required to provide at least a 30-day notice of the cancellation if the company declares bankruptcy or is canceling your policy mid-term. Additionally, the transaction must be approved by Florida’s Office of Insurance Regulation. “Because Risk Rating 2.0 considers rebuilding costs, FEMA can equitably distribute premiums across all policyholders based on home value and a property’s unique flood risk,” according to FEMA. The move comes after the state’s insurer of last resort saw the number of its policies balloon to 1.3 million as multiple insurance companies went out of business, left the state or stopped selling policies in Florida.

The average cost of Security First home insurance in Florida is $721 per year, which is $1,500 cheaper than the annual statewide average of $2,288. The average cost of State Farm home insurance in Florida is $2,227 per year, which is about 3% cheaper than the Florida average of $2,288. Discounts and qualifications vary by insurance company, so be sure to talk to your carrier about your specific situation. Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate.

It is always a good idea to take photos of the damage prior to making temporary repairs, if possible. Receipt of the premium payment for the renewal policy by the insurer is deemed to be acceptance of the new policy terms by the policyholder. Insurers must provide a specific reason in their notice to the insured if it nonrenews a policy. They must also provide advance notice to the first named insured listed on the policy as specified below. A nonrenewal is the termination of an insurance policy at its normal expiration date.

Bankers Insurance doesn’t think the legislation went far enough to help homeowners insurance companies with fraud and litigation. The intent of this law is to allow an insurer to make a change in policy terms without nonrenewing policyholders they wish to continue insuring. In addition, it alleviates concern and confusion to the policyholder caused by the required policy nonrenewal if the insurer intends to renew the insurance policy, but the new policy contains a change in policy terms. The law is intended to encourage the policyholders to discuss their coverages with their insurance agents. Since Florida is the state most impacted by hurricanes, homes there are also at an increased risk of claim filing due to storm damage. Homeowners need to assess the insurer's rates, customer service, claims ratings, and financial stability to choose the best home insurance company in Florida.

No comments:

Post a Comment